Following is a set of posts from Valueguy on the Motley Fool, various posters on Silicon Investor, and me. The topic at hand is Noland"s latest

Credit Bubble Bulletin. Here is the discussion chain.

ValueguyMish I know you"ve addressed Noland"s views in the past. Since you enjoy doing so and since many of us are reading him, I think it"s worth thinking about what he"s saying. I for one am starting to be convinced, even though I can see commodity and house (and other) prices going down.

Noland writes:

As is reflected in the Q2 2006 Flow of Funds, there remains an overwhelming bias within the financial sector to leveraged existing assets (chiefly government, agency, and mortgage-related securities). This bias has intensified greatly during the third quarter. Ironically, the housing and economic decelerations are to this point engendering only a moderate slowdown in Non-Financial debt growth, while Financial Sector Expansion Goes into Overdrive. The system"s liquidity mechanism has not only become detached from the actual financing needs of the real economy, there is today a Powerful Propensity for Financial Excess to Accelerate Rapidly as the Economy Decelerates Only Moderately (too many waiting patiently to profit from another round of Fed largesse). This is a very important development.

To be sure, speculative leveraging these days in the fixed-income markets has an unparalleled capability of creating abundant liquidity for the markets and system generally. And as bond prices inflate in response to heightened speculative leveraging and resulting liquidity creation, those that had been positioned for higher rates (both speculations and hedges) are forced to unwind these trades � in the process creating only more price inflation and liquidity over-abundance. Meanwhile, the yield curve gyrates and causes bloody havoc for myriad curve and rate speculations.

I will be quite surprised if the Financial Sphere Horse does not once again pull the Economic Sphere Cart. Benchmark Fannie Mae MBS yields have now dropped 65 basis points from June highs. To what extent lower mortgage rates reignite housing markets will likely vary significantly by market. But they will surely incite an increase in transactions and, most likely, acceleration in already strong refinancings and equity extractions. Total Mortgage Debt growth can be expected to quicken from the first half�s 10.1% pace.

There is certainly nothing like a concurrent descent in energy prices and bond yields to get the inflation doves chirping rather maniacally. Yet, the reality of the situation is that sinking bond yields and attendant gross liquidity excess are poised to stoke fires for sectors already demonstrating flaming inflationary biases. Sitting near the top of the list, you should assume Mr. Income Inflation is salivating from recent market trading dynamics.

And, yes, Income Inflation is supporting inflated home prices that sustain the Mortgage Finance Bubble - that maintain over-consumption - that assures endless massive Current Account Deficits - that guarantee massive foreign buying of U.S. securities while writing yet another chapter in History�s Greatest Bond Market Bubble.

Valueguy Continues

What he"s saying is that all the assumptions that markets will crash because of an economic downturn may be false. Most of us see that we are having a slowdown, maybe margin compression, and as always Wall Street reacts violently. Well, he"s saying it"s just not true, he"s arguing that the fundamentals are detached from the market. Well, usually such views are wrong, and Noland himself (I think) believes that eventually stocks will crash. But why are people not scared?

MishInterestingly enough similar discussions were taking place on Silicon Investor.

Following is a chain of posts on SI

JimmgThere is a good interview on financialsense.com with my old friend Doug Noland this week. He thinks the economy will surprise on the upside for the short/intermediate term.

OrkriousAnother bear capitulates.

JimmgDoug is very bearish longer term but thinks the strong credit growth is leading to wage inflation which will support the economy and housing much better than most think. He might be right but I tend to think we are much closer to the bust.

RarebirdThis year has been remarkably similar to 1994 with a time lag of about a month. If the same pattern holds, I"d expect a very nice correction in mid October. I want to see Volkmar Hable capitulate and see OEX Option Traders buy tons of calls on the initial leg down. That is likely after the next fling to the upside. Currently I"m modestly long. But I"ll be short when it matters most.

Mish

Money supply as measured by M1 has been contracting.

Housing prices and sales are dropping fast in spite of whatever else is happening.

If there is extra liquidity, how much actual GDP is produced by it? Any?

It seems to me that it is taking enormous expansion of credit right now just to keep the ship from sinking.

The stock market may be acting well but the junk bond market and treasury markets are telling another story.

My conclusion is that "financial sector overdrive" is unsustainable in the current environment. Still that does not put a timeline on sustainability so let"s look at a few indicators to see what they are saying.

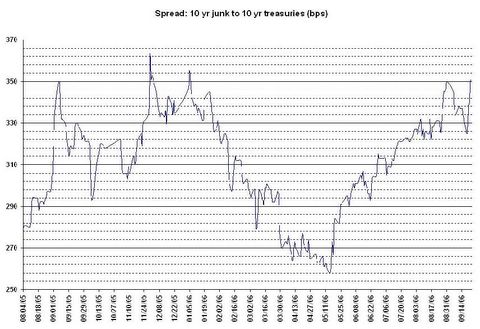

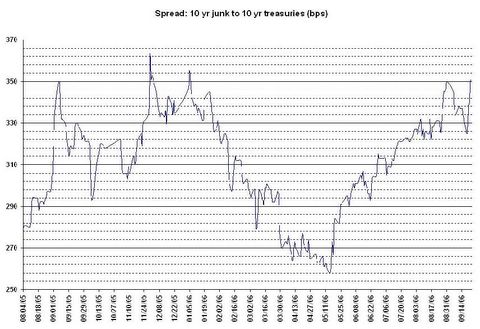

Here is a chart of junk bonds spreads vs. treasuries produced by Orkrious on Silicon Investor.

Orkrious maintains that chart daily and posts updates frequently on Silicon Investor. You can follow along

here.

Notice how stocks topped in May when the spreads narrowed. That was a perfectly normal action. Right now we have a huge divergence (the divergence can always get bigger of course), but I am inclined to believe the bond market.

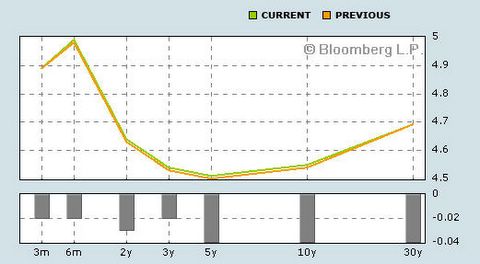

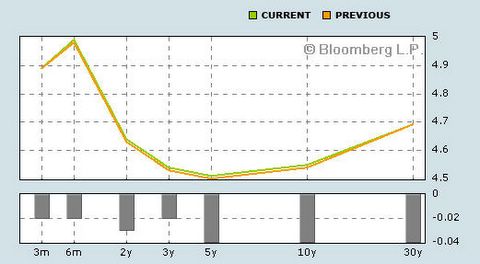

Here is the yield curve as of 2006-09-25

The treasury market and credit spreads both seem to be saying one thing while the stock market is pricing in a soft landing or better. One of them is wrong. A similar situation took place in 2000.

Bart at

NowAndFutures disputes Noland"s idea of wage inflation.

Here are a couple of charts produced by Bart in cooperation with from John Williams at

Shadowstats.

Employment Cost Index

Average Hourly Earnings

Bart explains his version of the CPI in

The Consumer Price Index, A Big Lie.

Regardless of whether or not one believes the "lie figures" as produced by Bart, there is no doubt the CPI has been manipulated for political purposes, just as the unemployment rates is manipulated for political purposes. The only real question is on the extent of the lies.

At any rate, the above charts show a decreasing employment cost index and modestly increasing hourly wages. I have several comments on wages.

- Averages are misleading.

- The biggest raises went to a small percentage of workers.

- Wages are a lagging indicator.

In addition, wages tell one story but job growth tells another. We have now had five consecutive months of subpar job growth including four consecutive misses prior to the latest month.

Wages and jobs are both important, not just wages. The only real bright spots in this recovery as far as job growth is concerned are medical related jobs and housing. There is no candidate to take up the slack for declining housing related jobs.

Note that cash out refis are drying up. The implications of that are pretty substantial. CalculatedRisk addresses mortgage extraction in

GDP Growth: With and Without Mortgage Extraction and

Mortgage Extraction and the Trade Deficit.

There are many stock market divergences as well including herding into winners, advance decline ratios, stock market breath, and an enormous divergence between the DOW and DOW Transports. For now the market seems fixated on a pause, sinking commodities (as if that will save consumer spending), as well as various improbable "Goldilocks" theories.

Reading Noland"s post in entirety I am not sure if this is exactly capitulation by another bear or not. That said, I obviously have a vastly different opinion from Noland on the yield curve, wages, commodities, inflation expectations, and a host of other issues.

I disagree with Noland"s proposal that the bond market will cause an

"acceleration in already strong refinancings and equity extractions". For starters, refinancings are not "strong" at least compared to previous peaks, and equity extraction is not likely to be "strong" in a now rapidly sinking housing environment. CalculatedRisk"s charts would seem to agree. Secondly, it appears that lenders are finally ready to address credit lending standards. A tightening of credit standards is likely to negate any effect of lowered interest rates. Finally the idea that "

Income Inflation is supporting inflated home prices that sustain the Mortgage Finance Bubble" is simply fallacious. Home prices and transactions have crashed since June of 2005 even as wages have risen modestly. It seems Noland is forgetting about affordability, the shrinking pool of eligible buyers, and lack of pent up demand. After all, who doesn"t have a house that wants one and can afford one? Noland"s capitulation may be debatable but he sure is missing the boat on many key issues.

Mike Shedlock /Mish

http://globaleconomicanalysis.blogspot.com/

It seems oddly fitting that on the day that President Barack Obama is set to sign his economic stimulus package into law, that the press is mainly obsessed with the fact that he"s doing so in Denver, Colorado. What does It All Mean? What statement does it make about Magical, Wonderful Bipartisanship? What can be divined by Obama"s decision to Avoid Washington? Pure window-treatment stuff. But what can you expect? The media have come to the end of a month of politicking over the economic stimulus and, from what I gather, have managed to mostly unlearn as much as they could about the principles upon which the proposed plan is based.

It seems oddly fitting that on the day that President Barack Obama is set to sign his economic stimulus package into law, that the press is mainly obsessed with the fact that he"s doing so in Denver, Colorado. What does It All Mean? What statement does it make about Magical, Wonderful Bipartisanship? What can be divined by Obama"s decision to Avoid Washington? Pure window-treatment stuff. But what can you expect? The media have come to the end of a month of politicking over the economic stimulus and, from what I gather, have managed to mostly unlearn as much as they could about the principles upon which the proposed plan is based.